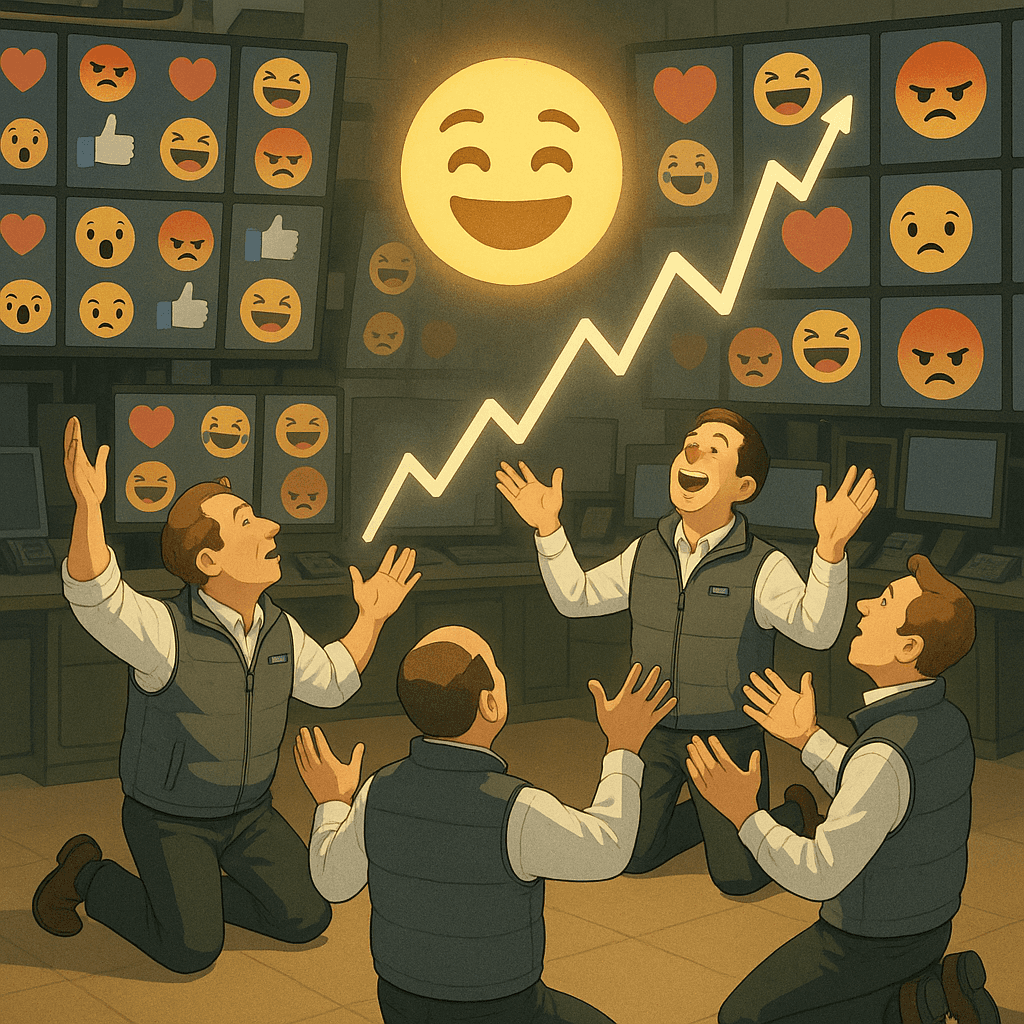

In the latest sign that capitalism has fully pivoted from measuring value to just guessing what people are doomscrolling about, Goldman Sachs today unveiled the GS Global Feelings Fund (ticker: FEEL), an exchange-traded fund that invests solely based on how mad, horny, or terrified retail investors are online at any given second.

The announcement came during a livestream hosted simultaneously on CNBC, TikTok Live, and a Fortnite concert stage, where an executive avatar in a Patagonia vest did floss dances every time the back-end sentiment index twitched by 0.1%.

“For over a century we’ve pretended stock prices track earnings, productivity, or at least some Excel sheet,” said Goldman’s newly appointed Chief Sentiment Officer, Brooke ‘Vibe’ Halperin. “Now we’re cutting out the middleman and tracking the only thing that actually moves markets: raw, unprocessed feelings expressed at 3 a.m. in the comments section.”

Halperin explained that the FEEL ETF will analyze millions of daily data points: Reddit rage-posts, Robinhood screenshot flexes, Discord meltdowns, and the precise duration of the pause before someone presses “Sell” on their phone. “If your thumb hovers for more than 0.7 seconds,” she added, “that’s a bullish micro-wince. We buy.”

The core of the new product is Goldman’s proprietary Emotion-Weighted Index (EWI), which abandons traditional market-cap weighting in favor of what Halperin calls “market-cap feeling.”

- Rage Weighting™: If a stock is being called a “scam,” “fraud,” or “my ex” more than 500 times per minute on X, the fund doubles its position.

- Cope Adjustment™: Every time someone posts “I’m in it for the long term” after a 40% drop, FEEL sells 2% to capture what Goldman describes as “the last remaining rational brain cell.”

- Hopium Multiplier™: Mentions of “to the moon,” “next NVIDIA,” or “this time is different” trigger an algorithmic margin loan to the ETF itself.

“We don’t look at PE ratios,” said Halperin. “We look at PE reactions.”

Despite skepticism from some corners of the industry, big-name backers lined up quickly. BlackRock reportedly considered a competing product that would track the average number of LinkedIn humblebrags per quarter, but instead chose to partner with Goldman on a suite of future spin-offs: FEAR (a short VIX of society), COPE (a bond fund for people who insist credit cards are “points strategies”), and FOMO, an ultra-levered ETF that buys whatever you were about to buy but slightly earlier.

“From meme stocks to crypto manias, we’ve seen that vibes beat math,” said one BlackRock executive, speaking on background because he was technically still on a panel about sustainable investing. “This is the logical next step in the slow, deliberate destruction of all traditional finance curricula.”

To build the FEEL data pipeline, Goldman partnered with several big tech firms already famous for extracting human emotion at scale. Meta reportedly contributed anonymized engagement data from Threads, Instagram Reels, and that cousin who shares AI-generated finance quotes over beach stock photos. Meanwhile, OpenAI provided a model that, according to a leaked internal slide, can calculate “retail despair per keystroke” with 93% accuracy.

“We trained the system on decades of historical market data and every comment ever posted under a Jim Cramer clip,” said a Goldman quant, staring into the middle distance. “At some point it started asking, ‘Why would you people do this?’ We interpreted that as emerging AGI, and immediately spun it out as a fund strategy.”

In a nice regulatory flourish, the company emphasized that FEEL is fully compliant with existing disclosure rules. The prospectus—1,200 pages of legalese and reaction GIFs—includes a new risk factor classed as Emotional Liquidity Risk:

“The Fund may experience sudden volatility if investors collectively decide to ‘touch grass,’ ‘log off,’ or ‘be so for real right now.’ In such events, the Fund may be forced to rebalance based solely on the emotional states of Goldman employees.”

A spokesperson for the SEC, which recently approved several spot Bitcoin products (Reuters, Jan 2024), appeared cautiously resigned. “Is it worse than half the things we’ve already okayed?” the spokesperson asked. “Absolutely. Can we explain why we let those through either? Not really. At this point we just check that the font size on the risk factors is at least 8 point and call it a day.”

Retail investors responded with their usual blend of enthusiasm and pathological denial.

“Finally, a fund that understands me,” said Tyler, 28, who described himself as a “full-time options trader, part-time shift lead at Chipotle.” Tyler plans to put his entire paycheck into FEEL every two weeks. “I don’t want some boomer picking stocks based on ‘cash flow’ and ‘profitability.’ I want a supercomputer reading my tweets and screaming with me.”

Within hours of launch, FEEL’s assets under management surged from $0 to $2.3 billion as major brokerages pushed it to the top of their apps’ “Trending” tabs, right above tax documents and the button that says “please stop showing me crypto.” Robinhood added a confetti animation specifically for FEEL purchases that shows a cartoon brain YOLO-ing itself off a candlestick chart.

Not everyone is thrilled. A group of behavioral economists from the University of Chicago issued a joint statement warning that financializing human emotion at scale could create “self-reinforcing cycles of panic and euphoria with catastrophic macroeconomic consequences.”

Goldman promptly licensed the phrase “Catastrophic Macro Euphoria™” and filed it for use on a forthcoming leveraged product.

“This is basically a derivative on the national mood,” said one skeptic at the World Economic Forum in Davos, where this year’s panels included “Can AI Fix Capitalism Before It Deletes It?” and “Is It Ethical for Hedge Funds to Own the Moon?” (FT, Jan 2025). “We’re turning vibes into securities. What happens when the vibes run out?”

Halperin dismissed such concerns, pointing to the backtested performance of FEEL, which assumed the fund existed during the 2021 meme-stock frenzy and the 2022 tech wreck. “In both scenarios, the fund did incredibly well,” she said. “Not in terms of returns—that part was a bloodbath—but in terms of user engagement. And at the end of the day, isn’t that what markets are really about?”

To reassure investors, Goldman is rolling out a robust educational campaign consisting of a 30-second pre-roll ad before every financial YouTube video. In it, a soothing voice explains that while past performance is no guarantee of future results, “the human capacity for bad decisions is virtually infinite, and FEEL is designed to capture that upside.”

The ad ends with the official tagline of the GS Global Feelings Fund, displayed over slow-motion footage of people staring anxiously at their phones:

“Don’t fight your feelings. Monetize them.”

As markets closed on the first day of trading, FEEL finished up 7%, then down 5%, then flat, then briefly halted after the system detected a nationwide spike in what engineers described as “vibes too weird to classify.” Trading resumed once the algorithm re-labeled the anomaly as “a normal Tuesday.”

Analysts now expect a wave of copycat products aimed at different demographic segments: a Gen Z-only version that invests strictly based on BeReal facial expressions, a Boomer version keyed to Facebook comment rage about paper straws, and a specialized ETF for founders that trades exclusively on the intensity of their Medium posts about “failing forward.”

Back on the livestream, Halperin smiled at the camera as a ticker crawled across the bottom of the screen: “Warning: Your feelings may lose value at any time.”

“In the long run,” she said, “all markets are irrational. We’re just finally charging a management fee for it.”