Interactive Brokers has seen the future of fintech, and it is turning the U.S. midterm elections into a volatility event you can chart in real time and ruin Thanksgiving over. According to a recent report (Channel NewsAsia, Jan 2026), the brokerage giant is betting that letting retail traders wager on U.S. midterm outcomes will "juice growth" of its platform. In other words, American democracy has officially been reclassified as an underlying asset.

Interactive Brokers, the platform beloved by quant cosplayers and people who think Excel is a personality type, is positioning election betting as the next logical step after zero-commission trading and zero-comprehension risk management. While Washington still argues over whether Meta should be allowed to show political ads next to your aunt’s banana bread, Interactive Brokers is out here asking the only question that matters in 2026: "What if C-SPAN had a DOM ladder and a margin call?"

The company’s pitch is simple: if traders can speculate on Tesla earnings, oil prices, and whether NVIDIA will be allowed to ship a GPU with more than four functional transistors to China, why not also speculate on whether the House goes red, blue, or full cyberpunk gridlock? Apparently, the midterms are no longer an off-year election; they’re a product line.

“We see political uncertainty as a growth vertical,” an imaginary Interactive Brokers executive did not say but almost certainly has in a deck somewhere. “Our users already bet their rent money on meme stocks. Moving to Congress is frankly an upgrade in fundamentals.”

The company told Channel NewsAsia that election markets should help expand their user base. Translation: there’s a massive, untapped cohort of people who never cared enough to vote but will absolutely open an account if you let them 3x-leverage a straddle on turnout in Maricopa County. Democracy as civic duty? Pass. Democracy as a gamified UI with confetti and a P&L heatmap? Install now.

In the old world, Interactive Brokers made money when people traded stocks, options, and futures. In the new world, the product team appears to have looked at the calendar, realized the U.S. holds federal elections every two years like a particularly expensive sports league, and said: "Wait, why are we not monetizing this seasonal content drop?"

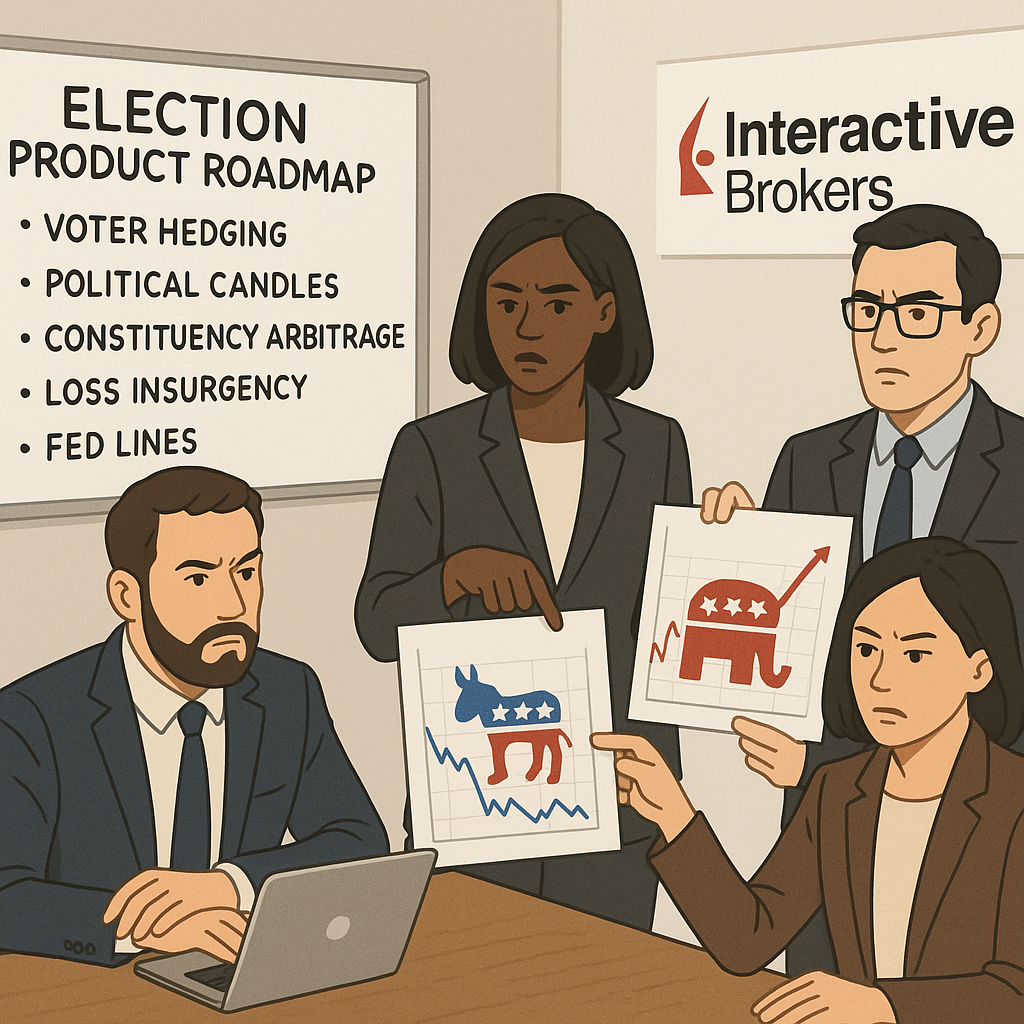

Thus was born the logical fintech roadmap:

- Phase 1: Commission-free trading.

- Phase 2: Options for people who can’t define ‘delta’ but use it in sentences.

- Phase 3: Crypto for when you’re bored of regulated sadness.

- Phase 4: Turn the U.S. midterm elections into a recurring revenue stream.

Somewhere, a compliance officer at Interactive Brokers is trying to draft language that explains how you can legally bet on whether the Senate flips, but you definitely can’t influence that outcome in a material, non-public way. Meanwhile, every political strategist in D.C. is recalculating ad buys now that “swing trader” and “swing voter” might literally be the same person.

Of course, this isn’t just about Interactive Brokers. The entire fintech sector is quietly furious they didn’t think of this first. Robinhood is probably storyboarding an animated spot where a cartoon ballot rides a rocket to the moon. Coinbase is rehearsing a keynote in which Brian Armstrong insists that on-chain governance tokens for the House Agriculture Committee are the future of freedom. Binance would have launched a perpetual futures market on the Speaker of the House months ago, but they’re busy explaining to regulators why their last product wasn’t technically a casino, just casino-adjacent.

Meanwhile, traditional polling firms are facing their worst nightmare: a candlestick chart that makes them look not just wrong, but unprofitable. Why answer a landline survey for free when you can instead buy a call option on a Wisconsin Senate race and experience financial and emotional pain simultaneously?

The gamification potential is nearly limitless. Imagine an Interactive Brokers dashboard where:

- Real-time vote counts stream in like Level 2 order book data.

- Counties with delayed reporting get labeled "illiquid."

- Exit polls appear as “forward guidance” with a confidence band and a big red "Not Investment Advice" disclaimer.

Push notifications could warn you: "Volatility alert: A Senate candidate just tweeted. Consider adjusting your position or your expectations for the Republic." A calendar widget could show "Earnings season" in one color and "Democracy patch day" in another. The same people who set options alerts at 2 a.m. will now be setting “filibuster risk” alerts before brunch.

There are, admittedly, a few ethical questions. Is it a conflict of interest if a billionaire PAC donor also happens to be shorting the probability of their own candidate winning? Does insider trading apply when the insider is a campaign staffer with early access to a particularly devastating debate clip? Will the SEC and the FEC ever agree on who has to pretend to be in charge of this?

Regulators famously move at glacial speed, which is adorable in a world where Interactive Brokers can spin up a new derivatives market faster than Congress can load a PDF. By the time a joint SEC–CFTC–FEC task force drafts an 80-page PDF about "novel electoral risk instruments," retail traders will be on their third election cycle, their fifth congressional scandal, and their 12th blog post about how this time, Ohio really is the new tech hub.

But from a pure business-growth perspective, the logic is brutal and flawless. The U.S. midterm elections are:

- Predictable in timing.

- Horrifyingly unpredictable in outcome.

- Endlessly covered by cable news in monetizable 30-second increments.

- Already a source of anxiety for millions who are not yet earning yield from that anxiety.

Interactive Brokers is simply offering to turn that psychic damage into a revenue stream. In a sense, it’s efficient: instead of doomscrolling Twitter for free, you can now express your despair with a sophisticated options strategy and a mild risk of bankruptcy. Late-stage capitalism has discovered a way to IPO your feelings.

So yes, letting traders bet on U.S. midterm elections might well “juice growth” for Interactive Brokers. The question is what else it juicies. Voter turnout? Civic engagement? Conspiracy threads on Reddit explaining how a sudden spike in volume on a Georgia House race at 3:17 p.m. proves the whole system is rigged by a cabal of quant funds and retired dentists in Florida?

Either way, the line between Wall Street and Washington just got one step blurrier. The midterms are now an asset class, the electorate a liquidity pool, and your faith in institutions just another thing to hedge. Welcome to 2026, where democracy doesn’t die in darkness—it just trades after hours.