In an age where every fintech startup insists it has "reinvented trading" by putting Chrome DevTools screenshots in its pitch deck, TwentyOneVC has arrived to assure us that, no, actually they are the ones who have solved latency, risk and your crippling fear of checking your portfolio. According to a recent glowing write-up on TechBullion about “21vc.io Review: Breaking Down TwentyOneVC’s High-Performance Trading Technology” (TechBullion, Jan 2026), the platform promises hedge-fund-grade performance to retail traders, which historically has gone very well for retail traders.

TwentyOneVC, the outfit behind 21vc.io, pitches itself as the Formula 1 team of algorithmic trading: sleek dashboards, low-latency infrastructure, and enough acronyms to stun an MBA. The company touts “institutional-grade execution” delivered straight to your laptop, the very same laptop you once used to mine Dogecoin and watch six-hour YouTube explainers on why you’re still early to crypto.

The TechBullion review gushes about their "high-performance trading technology" like it just swiped right on a cross-collateralized soulmate. We’re told that TwentyOneVC combines lightning-fast order routing, machine-learning-driven strategies, and a risk engine that presumably does more than put a little red line next to your account balance and whisper, "Yikes." What it doesn’t do is slow you down long enough to ask the only important question: Why does anyone want me trading this fast?

TwentyOneVC’s fans say 21vc.io is about democratizing access to sophisticated tools previously reserved for the likes of Citadel and other entities that make money when you remember your password. Detractors say it’s about giving every Robinhood refugee access to a glorified “enhanced wreck button.” Both are probably correct.

In marketing materials inexplicably not quoted by TechBullion, a hypothetical TwentyOneVC product manager might describe the stack like this:

- Ultra-low latency: Orders zip from your mouse click to the exchange in under 10 milliseconds, so you can front-run your own regret.

- Smart order routing: An algorithm decides which venue will execute your terrible idea the fastest.

- Quant-grade strategies: Pre-built models backtested on historical data from the one decade where the line only went up.

The core promise of 21vc.io is simple: if high-frequency traders can vaporize each other’s alpha at the speed of light, why shouldn’t you get to vaporize your net worth at the speed of Wi‑Fi? TwentyOneVC appears to be betting that the main thing holding you back from consistent losses is the extra 300 milliseconds your current broker wastes rendering a candlestick chart.

To fully appreciate the ambition here, imagine you combined Interactive Brokers’ terrifying interface with Robinhood’s color palette and then bolted on a “pro mode” that asks, “On a scale of 1 to 10, how much leverage do you feel you emotionally deserve?”

According to TechBullion’s review, TwentyOneVC’s tech stack leans heavily on cloud-native microservices, colocated servers near major exchanges, and proprietary optimizations that shave microseconds off trade execution. In theory, this lets your order slip into the market just before someone else’s bot slaps the ask. In practice, it lets you lose slightly faster than the next guy and then blog about it.

“Our mission is to level the playing field,” a totally real-sounding fictional spokesperson for TwentyOneVC, whom we’ll call Alex from Product, might say. “For too long, institutional players have had access to speed, data, and risk tools that retail traders didn’t. With 21vc.io, we’re bringing that power to everyone, especially people who learned options trading from TikTok.”

Alex might go on: “People complain that 90% of traders lose money. But nobody asks the deeper question: how quickly are they allowed to lose it? We optimize for that.”

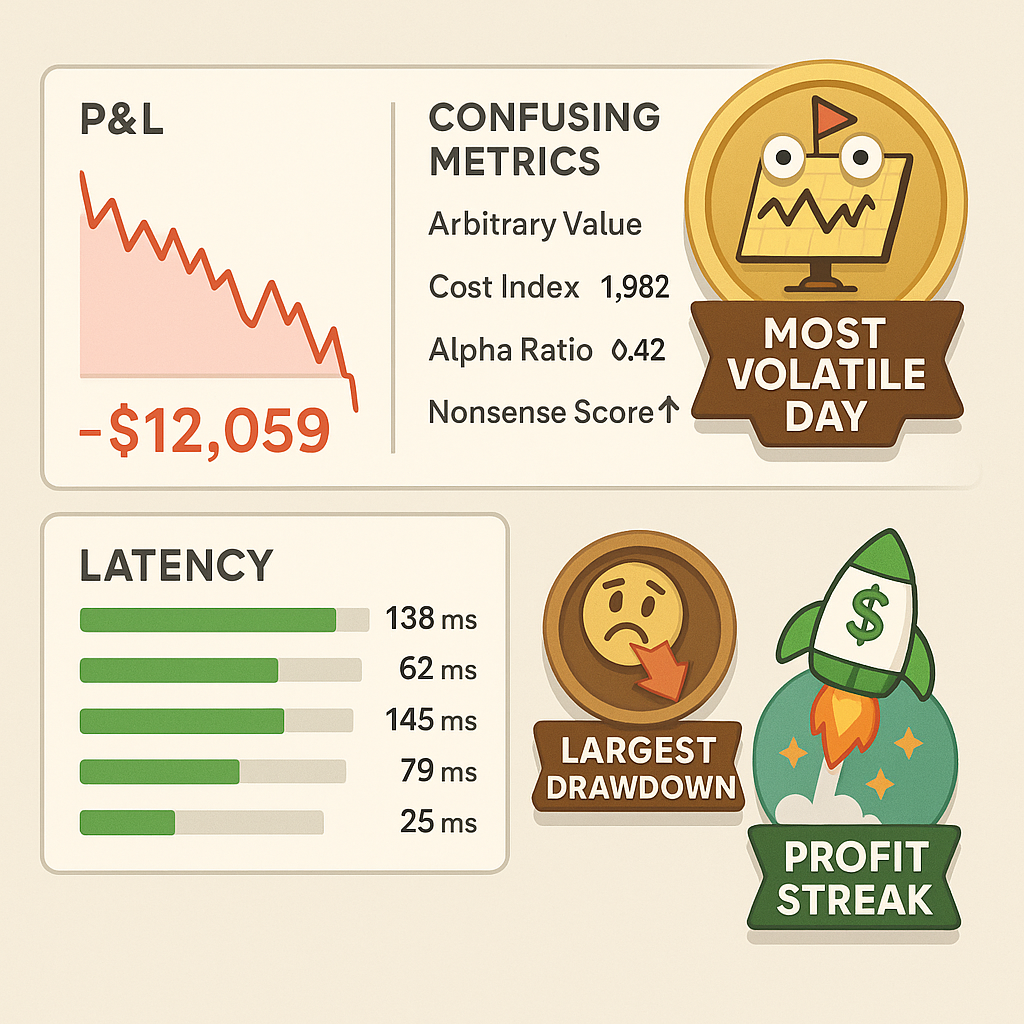

Of course, no high-performance trading platform is complete without a dashboard bursting with metrics you will pretend to understand. TwentyOneVC’s interface, as breathlessly described in the TechBullion piece, features real-time P&L charts, position greeks, and enough color-coded heatmaps to qualify as modern art.

Example screen elements, as imagined by your correspondent:

- Sharpe Ratio: A number that oscillates between 0.1 and “don’t show my spouse.”

- Max Drawdown: Confirming that what you called a “dip” was in fact a “cliff.”

- Latency Monitor: A smug green bar that stays perfect while your strategy doesn’t.

TwentyOneVC insists none of this is about encouraging reckless behavior. The platform, according to the TechBullion review, comes with risk controls, margin safeguards, and algorithms that “optimize capital efficiency,” a phrase that historically means “you can blow up more spectacularly with less capital than ever before.” There are apparently guardrails, but as any engineer will tell you, guardrails are what you hit immediately before going over the edge.

This is the natural endpoint of fintech’s favorite word: democratization. We democratized commission-free trading, so everyone could discover that they are not, in fact, the main character of “The Big Short.” We democratized options, so people could learn that theta decay is not a Marvel villain but behaves like one. Now, with TwentyOneVC and 21vc.io, we are democratizing low-latency, algorithmic execution. You get the same gun as the professionals; the difference is they know which end is which.

One can almost imagine the elevator pitch TwentyOneVC used to land its seed round:

“We’re like Citadel meets Robinhood meets AWS, but for the creator economy of degenerate traders who learned Python last week.”

To be fair, some of this tech is legitimately impressive. Building a globally distributed, low-latency trading platform is non-trivial. Syncing order books, handling fragmented liquidity, managing exchange-specific quirks – that’s real engineering. It’s not quite “land a rocket vertically on a drone ship” hard, but it’s at least “turn a fintech idea into something other than an Excel sheet” hard.

The problem is that the value of speed is wildly asymmetrical. For a market maker, shaving 100 microseconds off execution can be the difference between profit and loss on millions of trades. For a day-trader in a Discord channel called “STONK WARRIORS 24/7,” shaving 100 microseconds off execution is the difference between buying the top and buying the top slightly earlier.

Still, the narrative of empowerment is irresistible. TechBullion’s coverage positions TwentyOneVC as a sort of benevolent infrastructure layer for the ambitious retail trader, giving them “tools historically used by hedge funds and proprietary trading desks.” Because when you look at the financial crises of the last few decades, the clear takeaway is that retail investors didn’t have enough access to complex, leveraged instruments deployed at scale.

In the likely event that 21vc.io becomes popular, expect the following entirely predictable cycle:

- Early adopters brag on X about “finally going institutional” with TwentyOneVC.

- Someone posts a thread explaining how they turned $10,000 into $120,000 in three weeks using a “simple” mean-reversion strategy running 24/7.

- A lot of people quietly turn $10,000 into “a valuable learning experience.”

- Regulators show up, ask what “gamma scalping” is, and leave more confused than when they arrived.

By then, TwentyOneVC will likely have moved on to new product lines: AI-generated strategies, auto-hedging portfolios, maybe an “Emotionless Mode” that locks you out when your heart rate spikes and you type the word “all-in.” The 21vc.io roadmap practically writes itself: social features, copy-trading, NFT badges for “Most Volatile Day,” and eventually a full-blown marketplace where quants sell strategies to the optimistic and sleep-deprived.

For now, TwentyOneVC and 21vc.io occupy that familiar tech sweet spot: impressive engineering, seductive marketing, and a user base that is absolutely sure this time they’re earlier, smarter, and more disciplined than all the people who came before them. Maybe they are. Or maybe, as always, the true high-performance strategy belongs to the platform itself, quietly earning spread, fees, and order flow while your Sharpe ratio does interpretive dance.

High-performance trading technology, after all, doesn’t care who wins. It just cares that the packets arrive on time.